inter alia

3/3/09

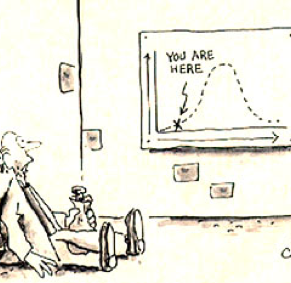

Politicians are fond of citing statistics, despite the fact that many political commentators are equally fond of citing Twain’s “there are lies, damned lies, and statistics.” Nonetheless, the statistics of a matter can be evident and fairly straightforward—like those for cell phone-caused brain cancer or autism linked to vaccines—and people will not behave, let’s say, rationally in response to those fairly straightforward facts. Many people who don’t wear a seat belt in a car are scared of cell phones, being hit by lightning in a thunderstorm, airplane crashes, falling meteorites and all the rest. All the statistics in the world won’t help you if you happen to be the extraordinarily unlucky person who gets hit by a bit of Skylab (although this might always happen instead), of course, but any number of cognitive scientists have noted that our brains seem poorly equipped to deal rationally with the risks of the modern world.

One reason we don’t seem to handle modern statistics very well is that whole narcissism issue: we place ourselves and our loved ones in a privileged position, leading to the “Lake Woebegone effect.” This is when all, or a large majority, of people are “above average.” There are situations where this actually can happen (Wikipedia notes that hardly anyone has three legs, but a much larger number of people, albeit still few, have one leg or no legs; therefore almost everyone has a number of legs that is “above average”), but it generally is a sign of a kind of diffuse narcissism. I have no doubt that about 90% or more of my students believe that they are above average in intelligence, even when they are compared to their immediate peers, who happen to also be my students. And in turn, professors are highly susceptible to grade inflation, doling out lots of A’s, a few B’s, one C, and no D’s or F’s—if a C is average, then why are 95% of the students getting a B or an A? (That’s why I’m in favor of departments adopting required grading on a modified curve, but that’s for another day.)

These amusing examples of hypocrisy meeting narcissism aren’t always so funny, and sometimes have serious consequences. For example, Al Gore pointed out that Bush’s tax cuts would primarily help the richest 1% of Americans, a criticism that many thought would be potent against Bush—instead there was hardly any effect at all. Why? Because 19% of Americans surveyed thought that they were in the top 1% of the country in terms of wealth, and another 20% thought they would be in that 1% bracket soon. Almost 40% of Americans believe that they are in or somehow near the top 1% of wage earners. To put that in more concrete terms, that means earning around $500,000 per year or more. No doubt it would have been more effective to critique Bush by saying most of the benefits would go to those earning half a million or more, but that doesn’t help the narcissistic effect of the second 20%, the hopefuls, the “I’ll get there someday.” Many Americans vote on the basis of the imaginary incomes and lifestyles they would like to have, rather than those that they actually do. After all, who would vote for a bill to tax lottery winnings at 90%, because what if you won the lottery the next day? Boy, would you be a sucker! (You are actually more likely to be struck by lightning than you are to win a big state lottery, by the way.)

But as it turns out, a lot of people don’t understand how income tax works, including ABC News and most rich people. According to some recent reports (see link above), a lot of people earning more than $250,000 (Obama’s threshold for returning taxes to their pre-Bush levels) are desperate to earn less! Otherwise they’ll end up earning less than their lazier neighbors who have never managed to pull in more than $240,000 a year. This is a classic example of what conservatives hate—the whole system rewards Cadillac-driving welfare queens while robbing the rich. The way Washington sees it, the more I work, the more they tax! They want to stifle innovation and initiative. An honest man just can’t get ahead. One lawyer—quoted by ABC—is going to try to cut back on business until her income is “$249,999.” Otherwise, boy, will she ever have to pay the piper, unless the courageous but outnumbered Republicans in congress can pull off a miracle for the Gipper.

Maybe this sounds familiar, or maybe you’ve even thought that this is how income tax works. It isn’t, as the author of the article points out—income tax is based on brackets, so when you earn more, you only pay the higher tax rate on the “more” that you earned. Imagine two earners, where the tax rate is 10% before a quarter mil and then suddenly doubles to 20% at a quarter mil. Here’s Lazy:

Gross: $240,000 Taxes: $24,000 Net: $216,000

And here’s Workaholic:

Gross: $260,000 Taxes: $27,000* Net: $233,000

*$25,000 (10%) on the first $250,000, plus $2,000 (20%) on the next $10,000.

There is no point, ever, under any circumstances, in which Workaholic can have a lower, or even equal, net income if she grosses more than Lazy. Never. You can’t earn less by earning more under the American tax code; similarly, if you gross more, you will always net more. So why is ABC telling people otherwise?

I think Mr. Foser is giving way too much leeway to ABC and the lawyer they interviewed. He won’t quite come out and say it: this press coverage is not ignorant—it’s deliberately misleading. These are people who earn a lot of money; they went to school, and they probably have accountants, and like most upper middle-class people they probably talk a lot about money, investing, taxes and real estate with their friends and colleagues. The people like this that I know are very tax savvy, changing their legal state of residence to avoid paying higher taxes, constantly moving money around, finding tax shelters, and so on.

These are, in fact, fairly wealthy people who are just pretending they don’t know how income tax works (pretending to be stupid when you aren’t is called “Socratic irony,” by the way), and they’re pretending to do so in ways that are suspiciously like the ways that perhaps some working class people misunderstand income tax. Ways that reinforce the notion that higher taxes will lead the wealthy to cut back, earn less, hire fewer employees because it won’t be worth their while. You combine that with that 40% of the US who believe that they’re in the top 1% of wage earners and you can see why people don’t always seem to vote in their best interests. Are higher taxes always better? Probably not—but we won’t figure out anything at all about what’s best if we’re having a conversation in which no one understands (or is pretending to misunderstand) how taxes work to begin with.

PS

If you want some not-so-straightforward statistics, try to wrap you brain around the Monty Hall problem. It will probably take you more than one try. I understood it once. For a while.

Statistics

But

You think you’re somewhere else